All Categories

Featured

There is no one-size-fits-all when it revives insurance policy. Getting your life insurance policy plan appropriate thinks about a number of factors. [video description: Pleasant music plays as Mark Zagurski speaks to the camera.] In your busy life, economic independence can appear like a difficult objective. And retirement may not be top of mind, since it appears so far away.

Less employers are providing typical pension plan strategies and numerous firms have actually decreased or ceased their retirement plans and your ability to count only on social safety and security is in inquiry. Also if advantages haven't been minimized by the time you retire, social security alone was never planned to be enough to pay for the way of life you desire and are worthy of.

/ wp-end-tag > As part of an audio financial method, an indexed global life insurance coverage plan can aid

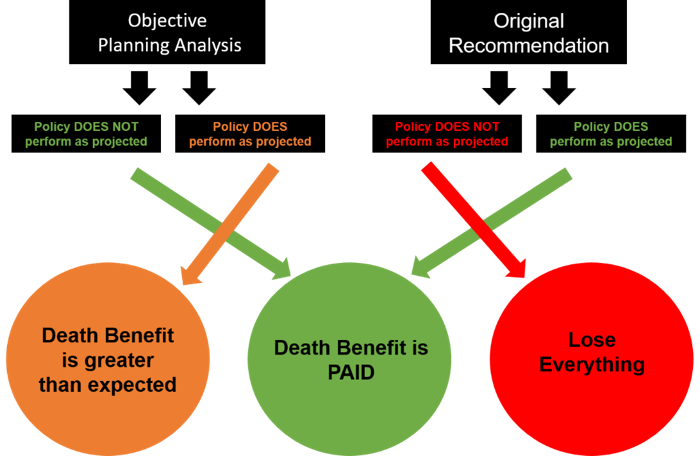

you take on whatever the future brings. Before devoting to indexed universal life insurance coverage, right here are some pros and cons to consider. If you select a great indexed global life insurance coverage strategy, you might see your money value grow in value.

Whole Life Insurance Vs Indexed Universal Life

Considering that indexed global life insurance policy needs a certain degree of risk, insurance companies have a tendency to maintain 6. This kind of strategy additionally supplies.

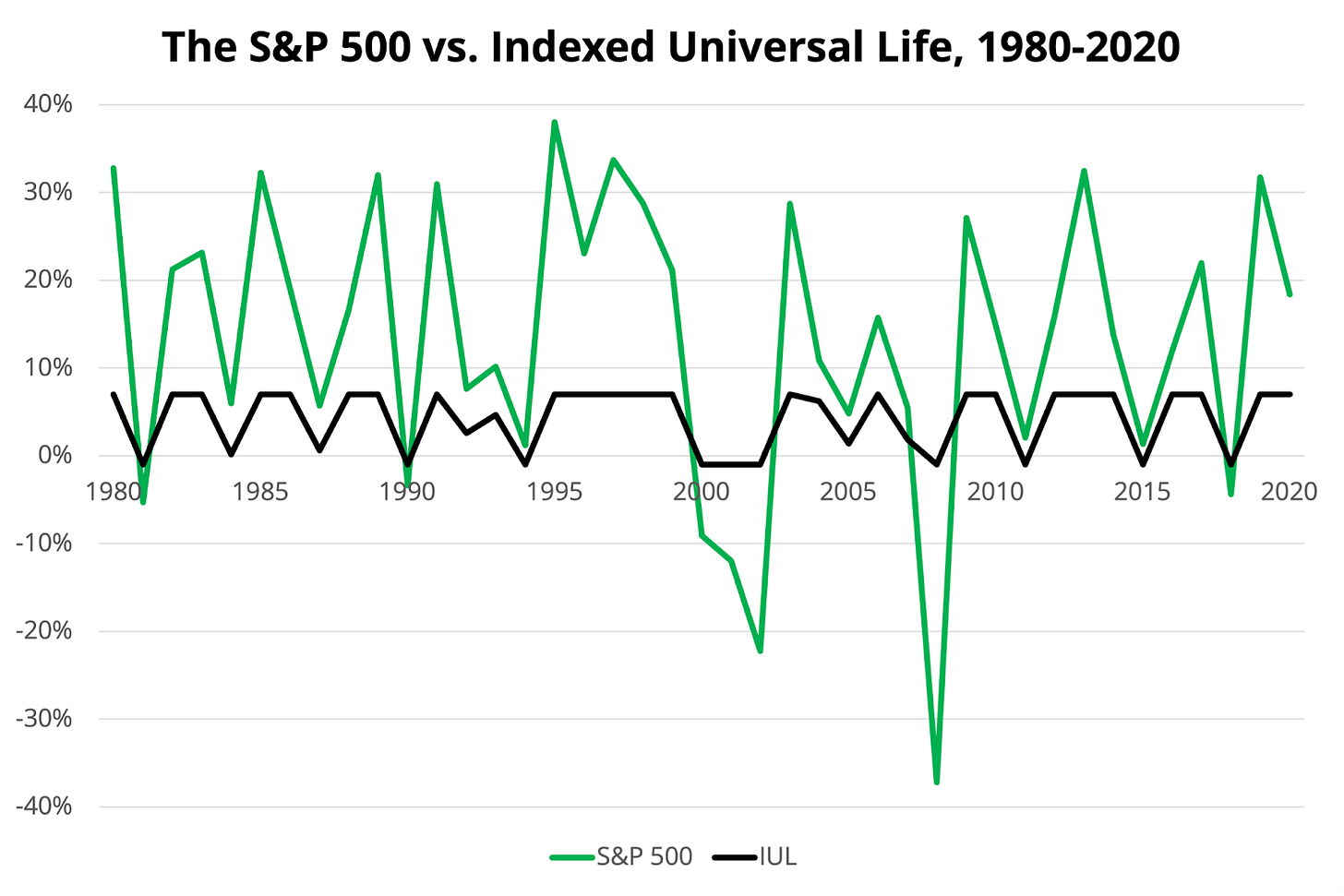

Lastly, if the chosen index doesn't carry out well, your cash worth's growth will certainly be impacted. Normally, the insurer has a beneficial interest in executing much better than the index11. Nevertheless, there is normally a guaranteed minimum rate of interest, so your plan's development will not drop below a certain percentage12. These are all elements to be considered when selecting the very best sort of life insurance policy for you.

Universal Life Tools

Considering that this type of policy is extra complicated and has a financial investment element, it can frequently come with greater costs than other plans like entire life or term life insurance. If you don't think indexed global life insurance policy is ideal for you, below are some choices to consider: Term life insurance is a temporary policy that typically provides insurance coverage for 10 to 30 years.

Indexed universal life insurance coverage is a kind of policy that provides more control and adaptability, along with greater cash worth development potential. While we do not offer indexed global life insurance policy, we can supply you with more info regarding whole and term life insurance policy plans. We suggest discovering all your alternatives and chatting with an Aflac representative to uncover the most effective fit for you and your family members.

The rest is contributed to the cash money value of the plan after fees are deducted. The cash worth is attributed on a monthly or yearly basis with interest based upon rises in an equity index. While IUL insurance may confirm beneficial to some, it is essential to comprehend exactly how it works prior to purchasing a plan.

Latest Posts

Veterans Universal Life Insurance

Indexed Universal Life Insurance Complaints

New York Life Indexed Universal Life Insurance